As expected the Bank of England Monetary Policy Committee voted to retain the Bank of England base rate at the present level of 0.75%pa.

The mortgage market remains competitive, some lenders have in the past week reduced their interest rates and arrangement fees. The level of lenders’ enquiries remains steady.

A few schemes which remain and are worth noting:

- 2yr fixed at 60% LTV – 1.44% pa, with a reduced lenders arrangement fee £999

- 5yr fixed offset at 60% LTV – 1.99% pa, with a lenders arrangement fee £999

- 5yr fixed at 60% LTV – 1.84% pa, with a reduced lenders arrangement fee £999

*LTV = loan to value

The above content does not represent a personal recommendation. If you have any questions on the buy to let sector reforms, rates or the mortgage market in general, our mortgage team is here to help. Please contact the team on 020 7444 4030 or by email.

Your home is at risk of repossession if you do not maintain mortgage payments.

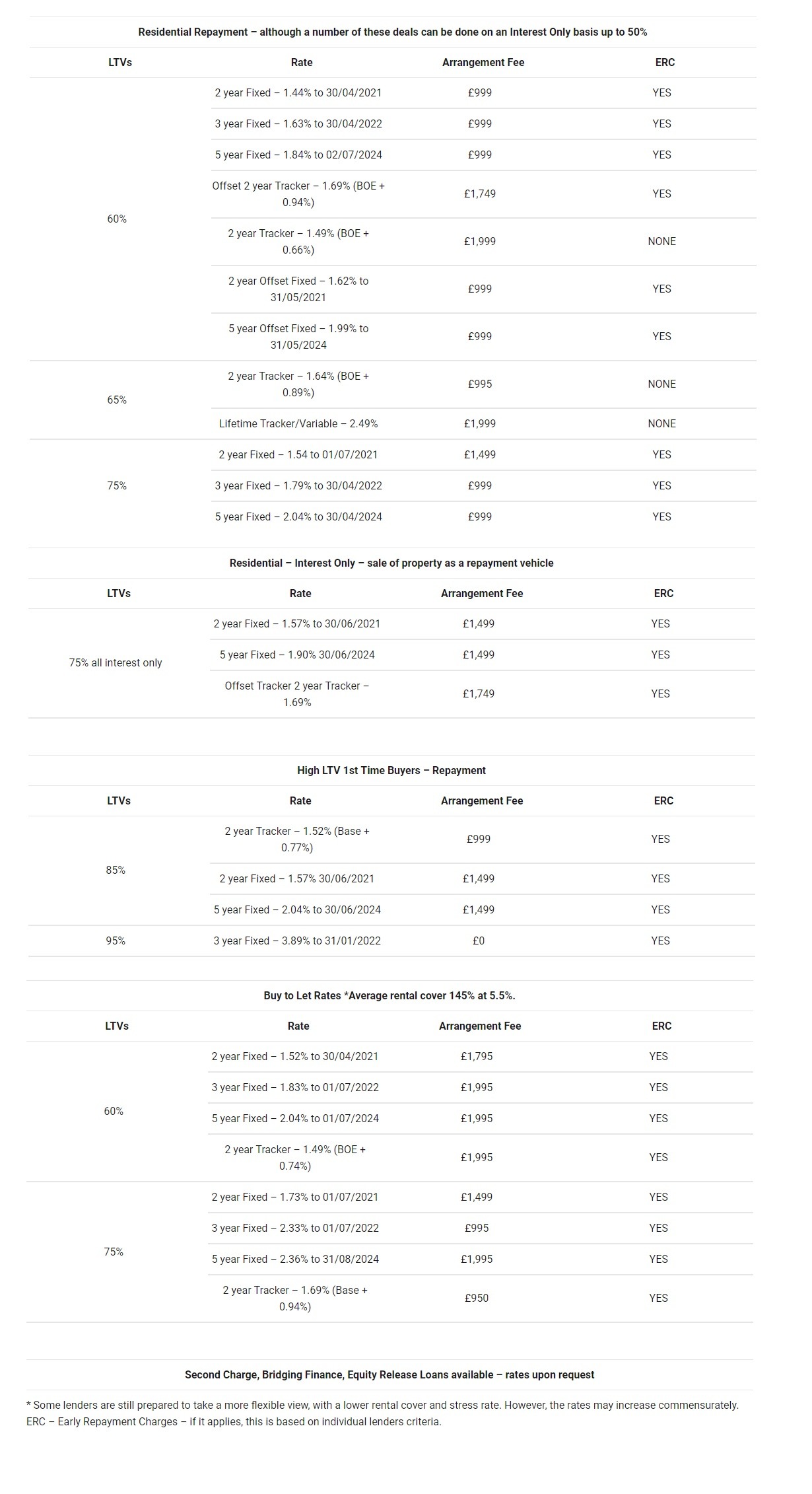

| Residential Repayment – although a number of these deals can be done on an Interest Only basis up to 50% | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 2 year Fixed – 1.44% to 30/04/2021 | £999 | YES |

| 3 year Fixed – 1.63% to 30/04/2022 | £999 | YES | |

| 5 year Fixed – 1.84% to 02/07/2024 | £999 | YES | |

| Offset 2 year Tracker – 1.69% (BOE + 0.94%) | £1,749 | YES | |

| 2 year Tracker – 1.49% (BOE + 0.66%) | £1,999 | NONE | |

| 2 year Offset Fixed – 1.62% to 31/05/2021 | £999 | YES | |

| 5 year Offset Fixed – 1.99% to 31/05/2024 | £999 | YES | |

| 65% | 2 year Tracker – 1.64% (BOE + 0.89%) | £995 | NONE |

| Lifetime Tracker/Variable – 2.49% | £1,999 | NONE | |

| 75% | 2 year Fixed – 1.54 to 01/07/2021 | £1,499 | YES |

| 3 year Fixed – 1.79% to 30/04/2022 | £999 | YES | |

| 5 year Fixed – 2.04% to 30/04/2024 | £999 | YES | |

| Residential – Interest Only – sale of property as a repayment vehicle | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 75% all interest only | 2 year Fixed – 1.57% to 30/06/2021 | £1,499 | YES |

| 5 year Fixed – 1.90% 30/06/2024 | £1,499 | YES | |

| Offset Tracker 2 year Tracker – 1.69% | £1,749 | YES | |

| High LTV 1st Time Buyers – Repayment | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 85% | 2 year Tracker – 1.52% (Base + 0.77%) | £999 | YES |

| 2 year Fixed – 1.57% 30/06/2021 | £1,499 | YES | |

| 5 year Fixed – 2.04% to 30/06/2024 | £1,499 | YES | |

| 95% | 3 year Fixed – 3.89% to 31/01/2022 | £0 | YES |

| Buy to Let Rates *Average rental cover 145% at 5.5%. | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 2 year Fixed – 1.52% to 30/04/2021 | £1,795 | YES |

| 3 year Fixed – 1.83% to 01/07/2022 | £1,995 | YES | |

| 5 year Fixed – 2.04% to 01/07/2024 | £1,995 | YES | |

| 2 year Tracker – 1.49% (BOE + 0.74%) | £1,995 | YES | |

| 75% | 2 year Fixed – 1.73% to 01/07/2021 | £1,499 | YES |

| 3 year Fixed – 2.33% to 01/07/2022 | £995 | YES | |

| 5 year Fixed – 2.36% to 31/08/2024 | £1,995 | YES | |

| 2 year Tracker – 1.69% (Base + 0.94%) | £950 | YES | |

| Second Charge, Bridging Finance, Equity Release Loans available – rates upon request |

|---|

* Some lenders are still prepared to take a more flexible view, with a lower rental cover and stress rate. However, the rates may increase commensurately.

ERC – Early Repayment Charges – if it applies, this is based on individual lenders criteria.