Offshore bonds are a common investment vehicle in the UK and have equivalents in most countries throughout Europe. They are non-income-producing wrappers that allow tax-free growth, meaning that income and gains realised within a bond are not usually taxed until a ‘tax event’ happens. Such events include death of the life assured, maturity of the policy (only relevant in some cases where the bond has a fixed term from the outset), withdrawals (potentially), complete surrender, assignment in part or full for money or money’s worth, and reclassification into a personal portfolio bond.

From an international viewpoint, tax is normally due in the country where the individual resides, except for US persons, for example. Assessing residence should always be the first step. Relevant tax treaties (if any) may be useful or necessary if the bond owner lived in different countries throughout the life of the bond. Reviewing the tax treatment of offshore bonds should always be done prior to moving in or out of the UK, as the timing of any withdrawals might affect the tax due on the ‘tax event’. Below, we consider tax treatment, but only from a UK perspective. It is important to remember that taxation depends on your individual circumstances and may be subject to future change.

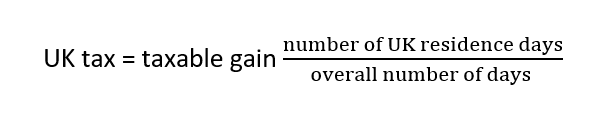

Firstly, if you lived abroad for any time while having the bond and you are a UK resident at the time of the withdrawal, you should be able to claim ‘time apportionment relief’ on the gain made on immediate withdrawal. This means that tax due on any gain of that particular chargeable event will be reduced by the ratio of the number of days spent in the UK, divided by the overall number of the policy.

As this is only applicable if the person liable for tax is UK resident at the time of the tax event arising, it may be preferable to delay triggering the tax event until becoming a UK resident again after a long time abroad. Equally, triggering it as soon as possible after becoming a UK resident should be more advantageous. There may also be benefits in realising gains overseas if, for example, you are a resident in a zero or low-tax jurisdiction.

For people who are resident but non-domiciled (please click here to access our guides), it is not possible to use the remittance basis to shield the gains from an offshore bond from UK tax.

Offshore bonds are always outside the remittance basis.

However, for such individuals, it may be preferable to invest in offshore bonds rather than pay the remittance basis charge (please click here to access our Remittance Basis guide). Furthermore, if the original investment was made from clean capital, it will be possible to withdraw up to 5% tax-deferred (per annum cumulatively) and use the funds in the UK without triggering further remittance tax. However, if the initial premiums were originally from mixed funds, the 5% withdrawals remain available only to spend offshore, and remitting any part of the withdrawal will force extra UK tax liability.

Regarding inheritance tax (IHT), offshore bonds can be particularly effective if the deceased was resident non-domiciled and was not resident for more than 15 years out of the last 20, as the bonds would be treated as being outside their estate. If the individual anticipates remaining in the UK for more than 15 out of 20 years, they should consider using an excluded property trust (EPT) in conjunction with such offshore bonds. EPTs should be set up during a non-domicile period and provide the advantage of removing the assets from UK IHT after becoming deemed domiciled. It does not matter if the beneficiaries are UK domiciled, as after the settlor’s death, the assets will continue to be excluded from the settlor’s estate for IHT purposes.

There are a number of ways offshore bonds can be used to minimise tax due in the UK. However, you should always obtain the correct advice to ensure they are the right product for your personal circumstances.

Adrien Landreau

Adrien Landreau

Partner

020 8051 9452

alandreau@partnerswealthmanagement.co.uk

Erez Erlbaum

Erez Erlbaum

Partner

020 8051 9451

erez@partnerswealthmanagement.co.uk

The contents of the article have been prepared solely for information purposes. The article contains information on financial products and services and such information is designed for and addressed solely to individuals seeking generic industry information. Past performance is no guide to future returns. The above content does not represent a personal recommendation. Taxation depends on your individual circumstances and may be subject to future change.