The Bank of England (BOE) Monetary Policy committee voted to retain the BOE Base Rate at the present level of 0.75%pa.

The mortgage market remains competitive; in the past weeks some lenders have reduced their interest rates and arrangement fees, especially in the buy-to-let market.

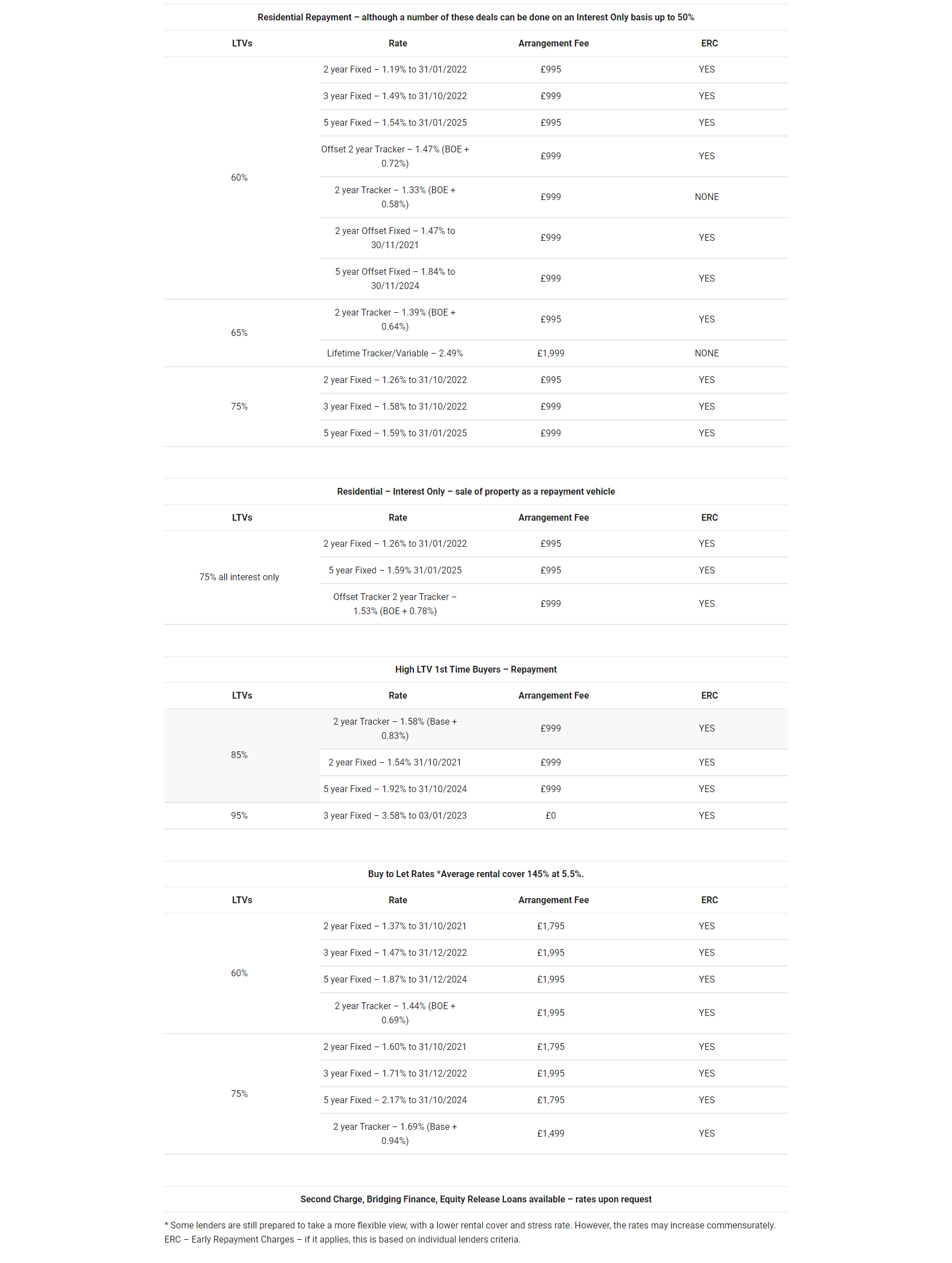

A few schemes which remain and are worth noting:

- 2 year fixed at 60% LTV – 1.19% pa, with a lender’s arrangement fee of £995.

- 5 year fixed offset at 60% LTV – 1.84% pa, with a lender’s arrangement fee of £999

- 5 year Fixed at 60% LTV – 1.54%pa with a lenders arrangement fee of £999

- Buy-to-let 2 year fixed rate at 60% LTV 1.37% with a lenders arrangement fee of £1,795

*LTV = loan to value

With attractive rates available, information published recently by the Office of National Statistics shows that house prices have continued to fall not only in London and the surrounding areas, but countrywide. Therefore, the combination of easing house prices and near record low mortgage rates means that the cost of owning a home is becoming affordable.

Mortgage approvals have continued to fall according to BOE figures. However, this is expected to improve in the Autumn with a large number of homeowners looking to re-mortgage their properties.

The mortgage market continues to evolve to meet the needs of a widening customer base, with new developments in buy-to-let mortgages, lending into and in retirement, intergenerational lending and support to first-time buyers. An example of this is the 10-year fixed-rate mortgage deal which is being offered by a growing number of lenders. Once the niche market product for homeowners, the assurance of a 10-year deal, with a homeowner knowing exactly what they will pay each month for a decade may be attractive for some. However, the lack of flexibility may equally be a turn-off. The average rates now available are 2.25-2.75% pa.

Future rates for ‘green’ households

Homeowners could benefit from reduced rates if they make their property more energy-efficient, under new Government proposals. The Department for Business, Energy and Industrial Strategy has launched a £5m fund to increase the number of “green mortgages” on the market. Such loans reward homeowners with lower mortgage rates by establishing a much more environmentally friendly property. Smaller lenders, such as Ecology Building Society, have offered green mortgages for a number of years in a bid to incentivise the use of energy-efficient technology when homes are being built or refurbished. However, such loans are yet to reach the mainstream.

The above content does not represent a personal recommendation. If you have any questions on the buy to let sector reforms, rates or the mortgage market in general, our mortgage team is here to help. Please contact the team on 020 7444 4030 or by email.

Your home is at risk of repossession if you do not maintain mortgage payments.

| Residential Repayment – although a number of these deals can be done on an Interest Only basis up to 50% | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 2 year Fixed – 1.19% to 31/01/2022 | £995 | YES |

| 3 year Fixed – 1.49% to 31/10/2022 | £999 | YES | |

| 5 year Fixed – 1.54% to 31/01/2025 | £995 | YES | |

| Offset 2 year Tracker – 1.47% (BOE + 0.72%) | £999 | YES | |

| 2 year Tracker – 1.33% (BOE + 0.58%) | £999 | NONE | |

| 2 year Offset Fixed – 1.47% to 30/11/2021 | £999 | YES | |

| 5 year Offset Fixed – 1.84% to 30/11/2024 | £999 | YES | |

| 65% | 2 year Tracker – 1.39% (BOE + 0.64%) | £995 | YES |

| Lifetime Tracker/Variable – 2.49% | £1,999 | NONE | |

| 75% | 2 year Fixed – 1.26% to 31/10/2022 | £995 | YES |

| 3 year Fixed – 1.58% to 31/10/2022 | £999 | YES | |

| 5 year Fixed – 1.59% to 31/01/2025 | £999 | YES | |

| Residential – Interest Only – sale of property as a repayment vehicle | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 75% all interest only | 2 year Fixed – 1.26% to 31/01/2022 | £995 | YES |

| 5 year Fixed – 1.59% 31/01/2025 | £995 | YES | |

| Offset Tracker 2 year Tracker – 1.53% (BOE + 0.78%) | £999 | YES | |

| High LTV 1st Time Buyers – Repayment | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 85% | 2 year Tracker – 1.58% (Base + 0.83%) | £999 | YES |

| 2 year Fixed – 1.54% 31/10/2021 | £999 | YES | |

| 5 year Fixed – 1.92% to 31/10/2024 | £999 | YES | |

| 95% | 3 year Fixed – 3.58% to 03/01/2023 | £0 | YES |

| Buy to Let Rates *Average rental cover 145% at 5.5%. | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 2 year Fixed – 1.37% to 31/10/2021 | £1,795 | YES |

| 3 year Fixed – 1.47% to 31/12/2022 | £1,995 | YES | |

| 5 year Fixed – 1.87% to 31/12/2024 | £1,995 | YES | |

| 2 year Tracker – 1.44% (BOE + 0.69%) | £1,995 | YES | |

| 75% | 2 year Fixed – 1.60% to 31/10/2021 | £1,795 | YES |

| 3 year Fixed – 1.71% to 31/12/2022 | £1,995 | YES | |

| 5 year Fixed – 2.17% to 31/10/2024 | £1,795 | YES | |

| 2 year Tracker – 1.69% (Base + 0.94%) | £1,499 | YES | |

| Second Charge, Bridging Finance, Equity Release Loans available – rates upon request |

|---|